Taxes & Assessments

Taxes

How do I pay my taxes?

Full payment and first installment payments must be paid to the City of De Pere. You can pay by mail with a check, online with a credit card, or in person at City Hall.

Pay online at this link: www.browncountywi.gov/propertytax

Use Guest sign-in. Enter Parcel# only in the Property# field for best results.

Online convenience fees: E-check $1.25, Personal Visa Debit Card $3.95, and Credit Cards/Other Debit Cards 2.55%

For information on the City's policy regarding overpayments, click here.

What are your hours at City Hall?

Mondays - Thursdays, 7:30 AM - 5:00 PM

Fridays, 7:30 AM - 11:30 AM

*second installment tax payments must be made to the Brown County Treasurer*

How can I get a receipt or a copy of my tax bill?

Avoid long lines at City Hall! If you include a self-addressed, stamped envelope with your mail or drop-box payment, we'll be happy to send you a receipt. Or, click here to search your property and view/print your receipt or tax bill.

Financial assistance for property taxes

There are several types of tax credits for which property owners may qualify. Click here to visit the Department of Revenue's website for more information.

The Wisconsin Housing and Economic Development Authority (WHEDA) provides property tax deferral loans for the elderly. Call 1-800-755-7835 for details.

Assessments, Explained

The subject of property assessments and their relation to taxes can be very confusing. On this page you will find answers to many common questions about property assessments:

What is an assessment?

How does my assessment affect my taxes?

Why is my property reassessed every year?

What do market conditions look like right now?

What do I do if I have questions about my home's assessed value?

Can an assessment be appealed?

What is an assessment?

An assessment is the value the assessor places on your property. This value determines what portion of the property tax levy (state, county, school district, and NWTC) is covered by your property.

Click here for helpful information on understanding your assessment, or here to watch a brief video created by the City's assessor.

Check out the Wisconsin Department of Revenue's Guide for Property Owners here.

How does my assessment affect my taxes?

Assessors don't set tax rates. There are no additional taxes collected by the City because of a revaluation. A change in your assessed value does not necessarily correlate to a change in your property taxes. There are many factors that go into the property tax rate; the revaluation does not change the amount of tax that needs to be collected by the city, county, school district, or technical college. The amount of property tax collected is redistributed after the market update, based on all properties being assessed to fair market value.

Why is my property reassessed every year?

In 2018 the City of De Pere decided to adopt an annual assessment process, which means that the assessor reviews all property within the City and modifies each to its current fair market value each year. Wisconsin law requires periodic market updates to keep assessments within 10% of actual market value. This year's assessment changes have reestablished equitable and uniform values for all properties.

What do market conditions look like right now?

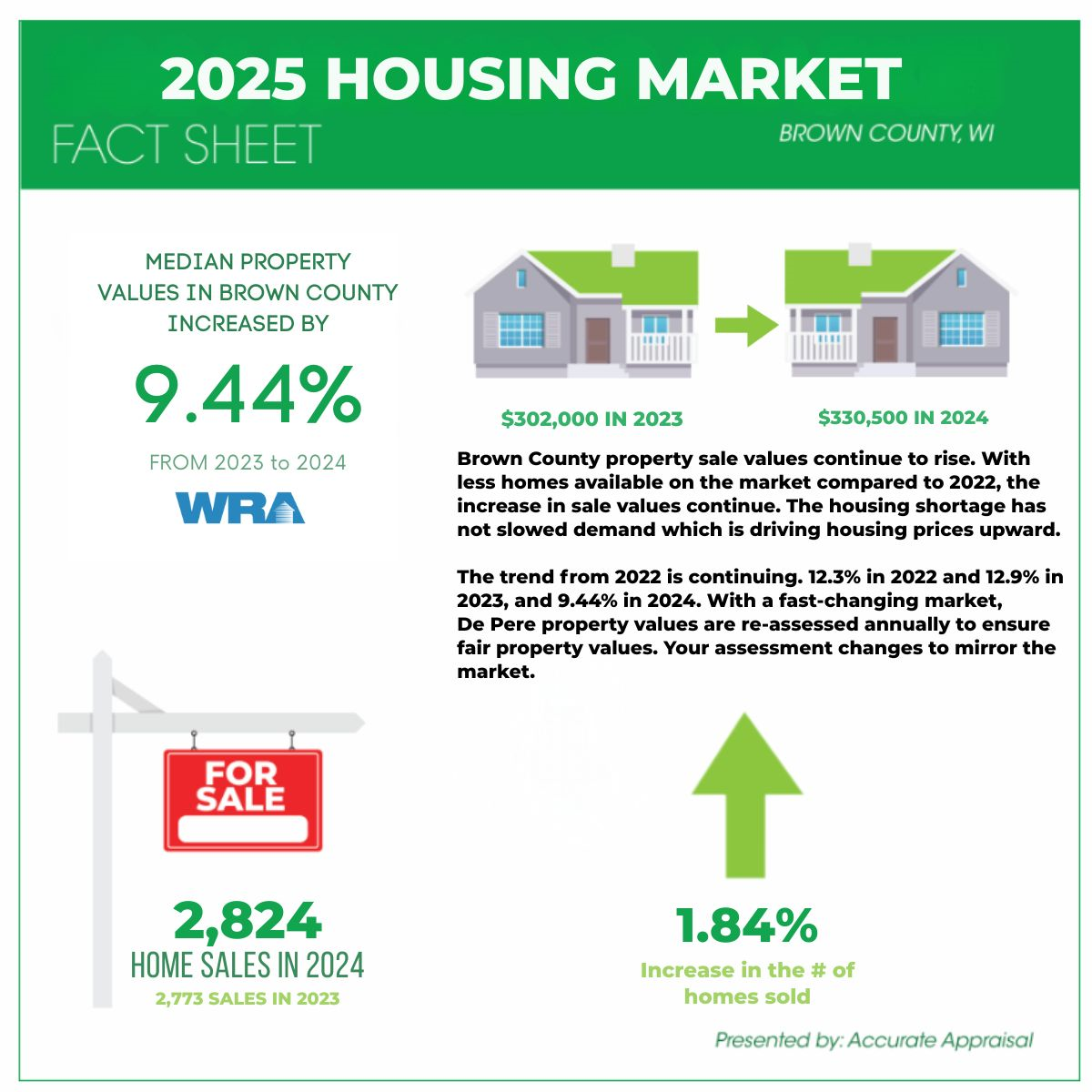

The 2025 assessment update has resulted in an overall community average increase of about 9%. We continue to see significant increases in real estate sales prices. The graphic below illustrates these continuing changes:

What do I do if I have questions about my home's assessed value?

Attend Open Book, which is a consultation with an assessor to discuss the value of your property.

2025 Open Book

In Person

Wednesday, April 30th from 9:00 AM - 12 PM and 1:00 PM - 4:00 PM

Thursday, May 1st from 8:00 AM - 1:00 PM

City Hall, 335 S. Broadway, 2nd floor Riverview Room

Visit accurateassessor.com and click the Open Book Assistant tab to schedule a specific appointment time on one of these days.

Visit accurateassessor.com

Click the Open Book Assistant tab

Complete the form

Select email response

An assessor will reply within two business days

Can an assessment be appealed?

If, after meeting with the assessor, you still disagree with your assessment, you may appeal it to the Board of Review. This five-member board is comprised of citizens appointed by the Mayor. The Board of Review functions like a court, and is required to evaluate evidence based on facts. You or your representative must provide factual evidence that your property is inequitably assessed. The burden of proof is solely on the taxpayer. The assessor's value is deemed correct by State law until proven otherwise.

2025 Board of Review

Thursday, June 5th from 10:00 AM - 12:00 PM

City Hall, 335 S. Broadway, 2nd floor Council Chambers

*deadline to file an appeal is Tuesday, June 3rd by 10:00 AM*

You must schedule your appearance at Board of Review with the City Clerk’s office by calling 339-4050, or e-mailing cdanen@deperewi.gov.

You must also file a Formal Objection Application Form with our office.

Contact Us

- Staff Directory

- Hours: Hours: Mon-Thurs: 7:30 a.m. to 5:00 p.m. Friday: 7:30 a.m. to 11:30 a.m.