Taxes

Understanding Your Property Tax Bill in De Pere

We understand that property taxes can be a confusing and overwhelming topic. To help provide clarity and transparency, please review the resources, educational information, and answers to frequently asked questions we’ve assembled below.

- When and how can I pay my taxes?

- Where do your taxes go?

- A deeper dive into the City taxes portion of your property tax bill

- Understanding why your tax bill may be increasing

- De Pere’s budget track record

- FYI: State law limits how much the City can raise its levy each year

- De Pere continues to remain competitive regionally

- What is the ‘Storm Wtr Mgmt’ charge on my tax bill?

- How can I get a receipt or a copy of my tax bill?

- Financial assistance for property taxes

- Helpful resources

- Contact us

When and how can I pay my taxes?

Property tax bills are typically available online and mailed out by mid-December, in accordance with Wisconsin state law.

Full payment and first installment payments must be paid to the City of De Pere. You can pay by mail with a check, online with credit/debit card or bank account information, or in person at City Hall.

If you’d like to pay online, use this link: www.browncountywi.gov/propertytax

Use Guest sign-in. Enter Parcel# only in the Property# field for best results.

Online convenience fees: E-check $1.25, Personal Visa Debit Card $3.95, and Credit Cards/Other Debit Cards 2.55%

You have several other convenient ways to pay:

- In person at City Hall during regular business hours

- Through your mortgage company, if they manage your escrow

- Drop-off anytime using the secure payment depository outside City Hall

- By mail.

- If paying by mail, please note that the U.S. Postal Service has recently changed their postmarking procedure - the postmark on your payment could be several days after you put it in your mailbox. Please plan accordingly to meet payment deadlines.

City Hall Hours:

Mondays - Thursdays, 7:30 AM - 5:00 PM

Fridays, 7:30 AM - 11:30 AM

Second installment tax payments must be made to the Brown County Treasurer

Where do your taxes go?

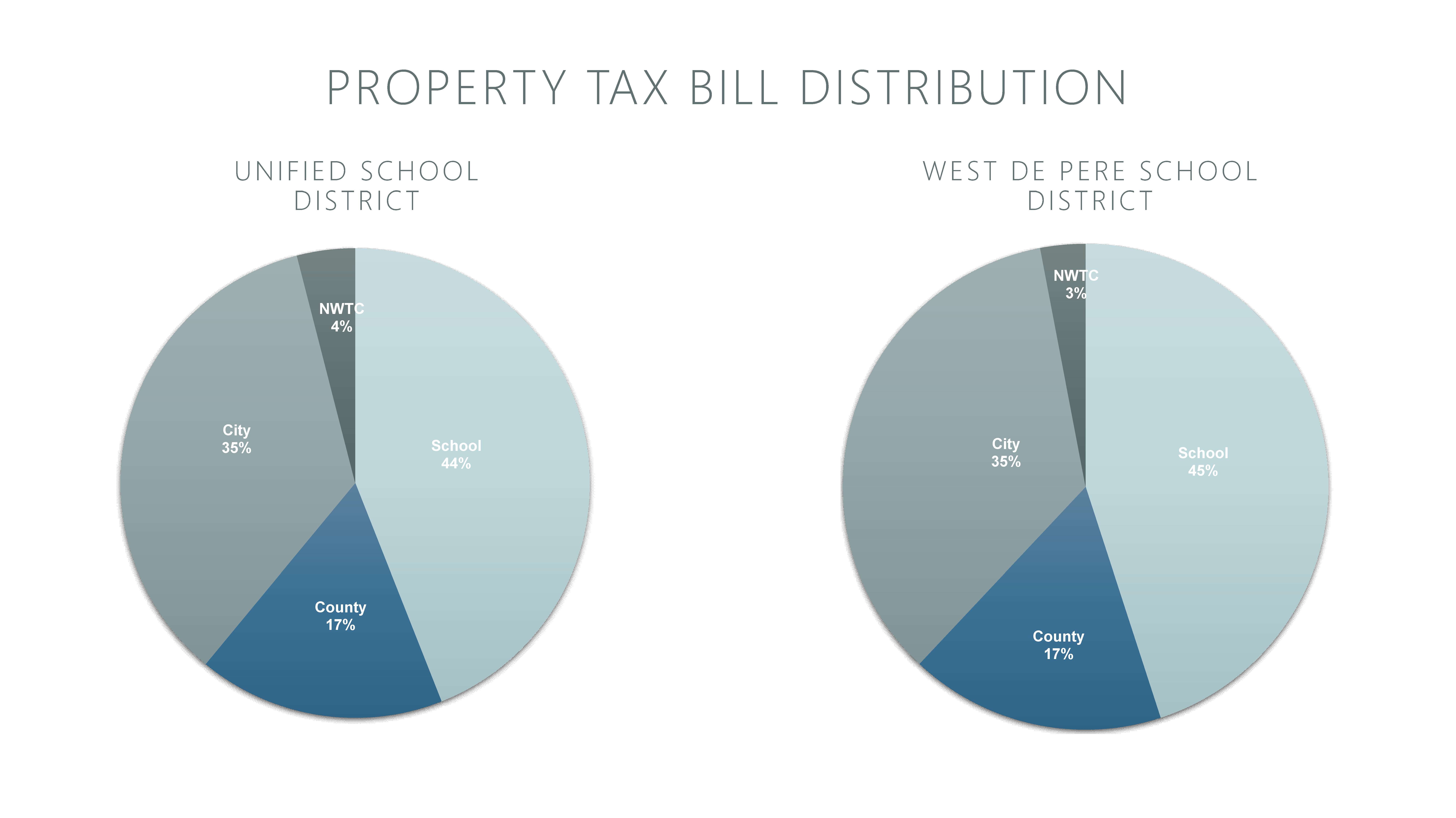

Property taxes often feel complicated, and it’s understandable that homeowners have questions—especially when bills change from year to year. Your total property tax bill includes charges from four separate taxing entities:

- Brown County

- Northeast Wisconsin Technical College (NWTC)

- The School District

- The City of De Pere

Each organization manages its own budget and sets its own levy. Some of these may go up while others go down, and your total tax bill reflects all those movements together.

The City portion is only one piece — usually around one-third of the total bill (see below for more information on what services and offerings the City’s portion funds).

Your property tax bill may also include a First Dollar Credit and a Lottery & Gaming Credit which reduce your gross tax bill.

A deeper dive into the City taxes portion of your property tax bill

It can be helpful to think of your property taxes on a monthly basis rather than as one large yearly bill.

For example:

A home valued at $300,000 might pay roughly $1,600–$1,800 per year to the City, which is about $150 per month for all City services combined. This includes:

- 24/7 police, fire, and EMS response from trained professionals

- Safer travel thanks to diligent snowplowing, regular street and sidewalk repairs, and traffic management.

- Clean homes and neighborhoods via garbage and recycling, yard waste pickup, street sweeping, on-street leaf collection, forestry, stormwater management, and other Public Works operations

- Parks, trails, pools, playgrounds, and recreational programming

- Community Enrichment: Older resident programming, youth engagement, community events, etc

- Long-term infrastructure investments that protect property values and support safe neighborhoods

- Much more

To put that all in perspective, compared to what many households pay monthly for streaming packages, cable television, cell phone plans, or gym memberships, the City’s portion of property taxes represents a broad, community-wide package of essential services that residents depend on every day.

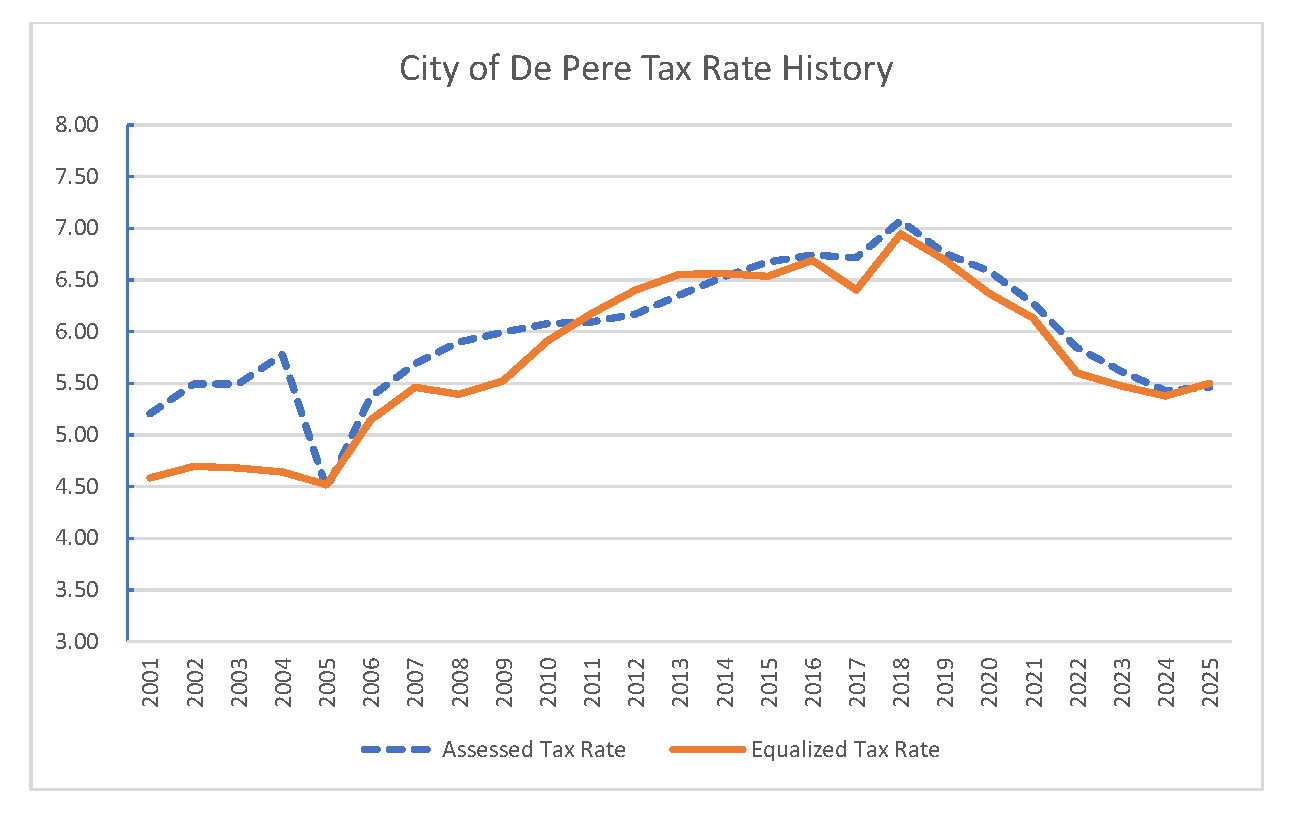

We understand that your total tax bill may be increasing, and it’s fair to ask why. City of De Pere residents have generally paid property taxes that calculate out to 1.4% to 1.8% of the assessed value. As mentioned above, the money paid for property taxes is split between the different taxing entities including Brown County, Northeast Wisconsin Technical College, the School District and the City. Each entity works through their own budgeting process in order to establish the tax levy needed for the following year. The combined rate is know as the ‘mill rate’. The City portion of the tax bill equates to .5% of the assessed value and that percentage remains the same for 2025. Because home values continue to increase, even rate decreases can result in a tax bill higher in dollar amount than the previous year.

Even when the tax rate stays flat, your bill can go up or down simply because your home is worth more or less than last year. It’s the combination of the tax rate AND your property value that determines what you pay.

Click here for more information on the assessment process in De Pere.

De Pere’s Budget Track Record

De Pere has a long track record of managing its budget responsibly. The City’s Aa2 Moody’s Bond rating reflects a growing economic base and healthy financial performance.

In the end, even as our population, infrastructure, and service needs have grown, the City has kept spending well below what it would be if it had risen at the pace of inflation over the last several decades, and the City continues to prioritize investments that maintain safety, protect and enhance neighborhoods, support community amenities, and build the infrastructure needed for future growth — all while maintaining financial discipline.

FYI: State law limits how much the City can raise its levy each year

Wisconsin places strict limits on how much municipalities may increase property tax levies annually. These limits are tied largely to net new construction, not inflation.

This means that even when:

- Operational costs rise

- Labor and equipment expenses increase

- Residents expect high-quality services

Cities cannot simply raise taxes to match the growing cost of providing services.

As a result, De Pere — like other Wisconsin communities — must budget strategically, rely on conservative financial planning, and balance community expectations with state-imposed limits. While difficult choices may arise in future years, De Pere remains committed to long-term responsibility and sustainability.

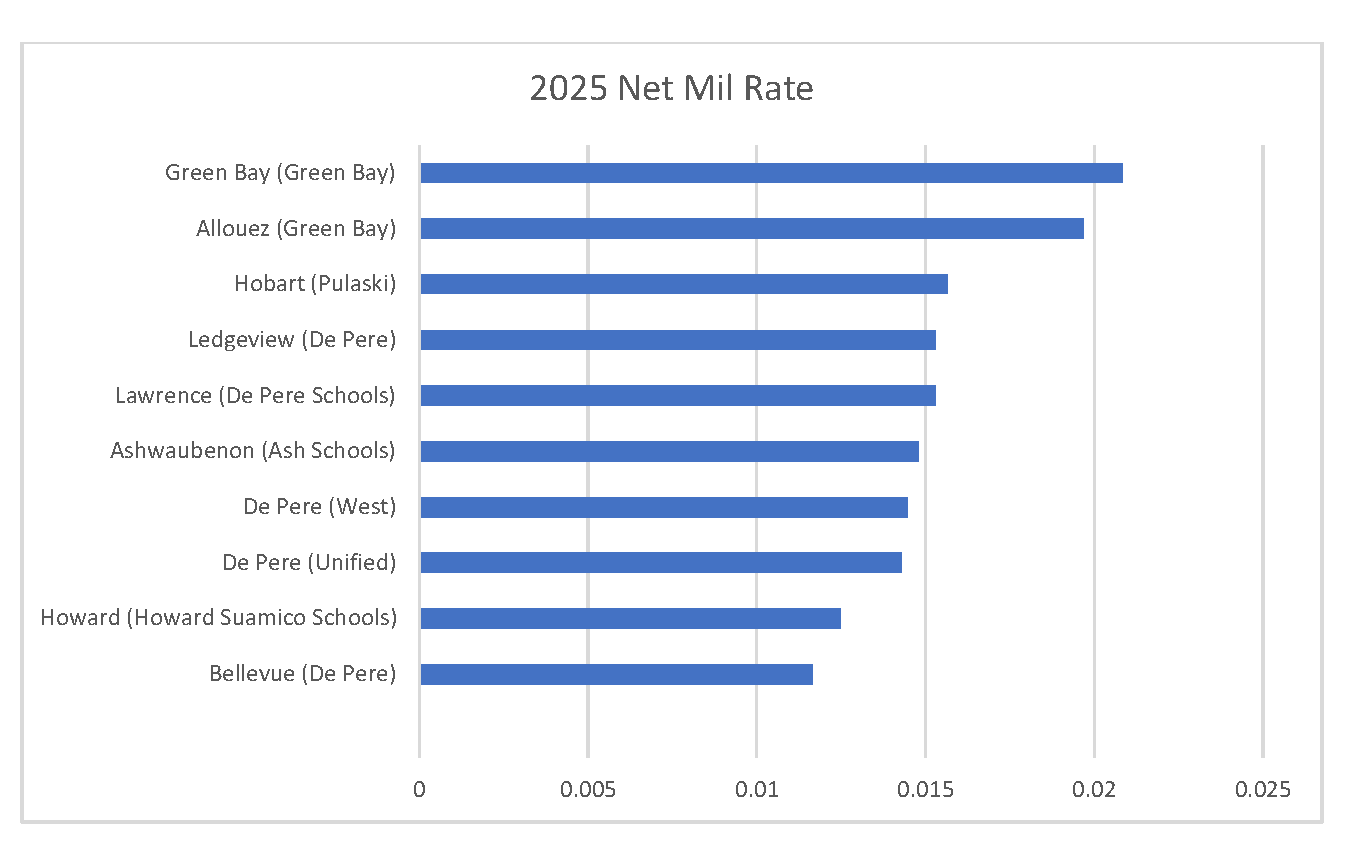

De Pere continues to remain competitive regionally

When comparing combined tax rates (City + school district + county + NWTC), De Pere consistently falls on the lower end among similar communities in the region.

Even though each entity adjusts its portion annually, the overall rate remains very comparable — often differing by just small percentages or even pennies between communities.

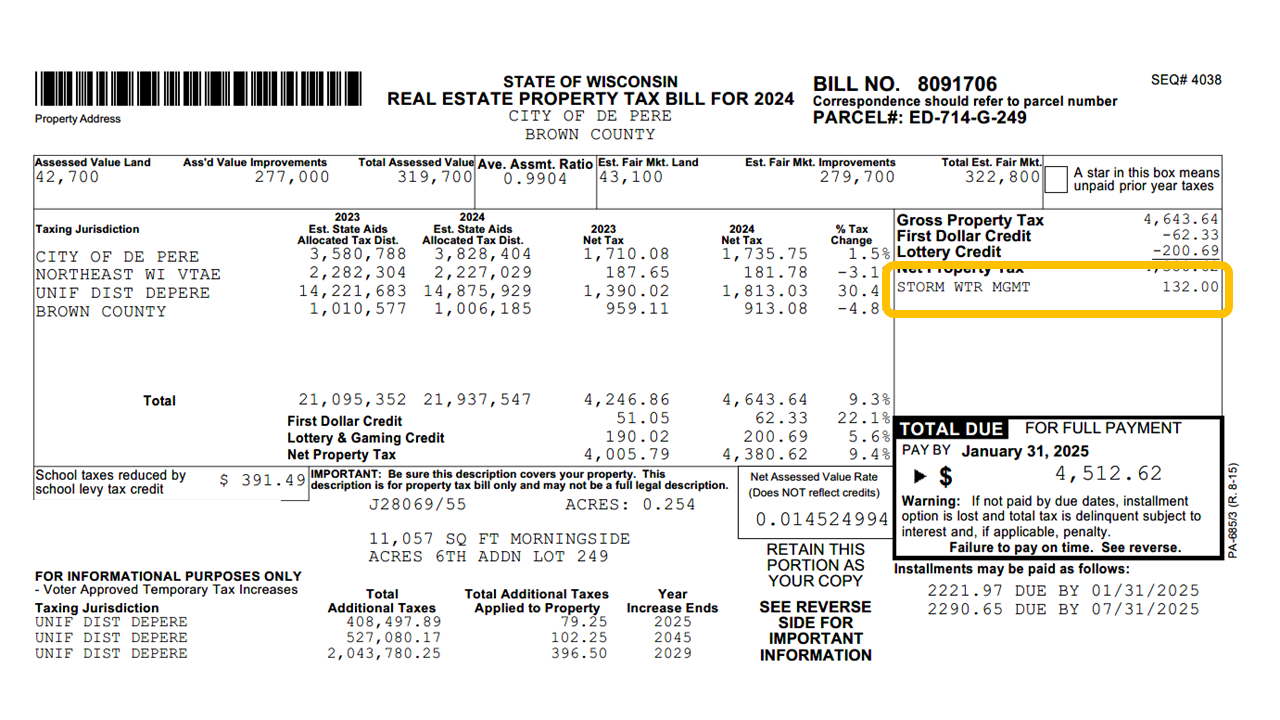

What is the ‘STORM WTR MGMT’ charge on my tax bill?

The City created a storm water utility as a more equitable way for funding needed maintenance and improvements to the City’s storm water management system. The storm water funds storm water management operation and maintenance activities. Activities include cleaning and routine repair of ditches, detention basins, storm sewers, catch basins, manholes, street sweeping, leaf collection, and construction of storm water treatment, detention, and conveyance facilities serving a public purpose. The storm water utility funds the following programs: Public Works Administration, Engineering, Municipal Service Center, Fleet Maintenance, Street Cleaning, Leaf Collection, Storm Sewer Maintenance, Landfill, and Weed Control. As part of the 2026 Budget the storm water utility fee increased from $132 to $142 per ERU.

How can I get a receipt or a copy of my tax bill?

Avoid long lines at City Hall! If you include a self-addressed, stamped envelope with your mail or drop-box payment, we'll be happy to send you a receipt. Or, click here[ to search your property and view/print your receipt or tax bill.

Financial assistance for property taxes

There are several types of tax credits for which property owners may qualify. Click here to visit the Department of Revenue's website for more information.

The Wisconsin Housing and Economic Development Authority (WHEDA) provides property tax deferral loans for the elderly. Call 1-800-755-7835 for details.

Helpful resources

For homeowners who want to dive deeper into how property taxes and the City Budget work:

- City Budget Hearing Video

- Approved City Budgets

- Wisconsin Department of Revenue: Guide to Property Assessment & Taxation

https://www.revenue.wi.gov/dor%20publications/pb060.pdf - General Tax Bill Explanation (Helpful educational reference)

https://localgovernment.extension.wisc.edu/2023-property-tax-bill-example/

Have more questions?

If you have additional questions that aren’t addressed here, we are always happy to help. Please contact us at 920-339-4050.

Thank you, and, in the end, remember your property tax bill reflects three things working together:

- What your home is worth

- Tax rates set by four different entities

- State rules on how cities are allowed to raise revenue

With these factors combined, small shifts in value or rates can change the final amount you owe — even when city spending remains consistent.

Contact Us

- Phone: (920) 339-4044

- Fax:

(920) 339-4049 - Staff Directory

- Hours: Regular Office Hours:

Mon-Th 7:30 a.m. – 5:00 p.m. Friday: 7:30am-11:30am