Tax Incremental Financing (TIF)

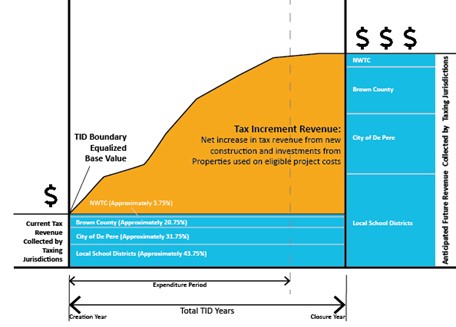

Tax Increment Financing (TIF) is a method of public finance often used by municipalities across the United States to subsidize redevelopment, infrastructure, and other community growth projects. The Wisconsin legislature passed the first TIF law in 1975, and municipalities across the state have used the mechanism to make improvements to specified TIDs. TIF helps to promote local tax base expansion by using property tax revenues to fund site improvements to attract new development, industry, rehabilitation/conservation projects, mixed-use development, blight elimination, and environmental remediation. During the development period, tax bases for the entities in question remain static at pre-development levels, while property taxes continue to be paid. The taxes derived from increases in property value within the TIDs (the tax increment) are diverted into a special fund at the city to pay for the costs of this redevelopment. Generally, the city will borrow funds to pay for initial development costs and use tax increments to retire debt. The city works with developers and property owners to provide infrastructure improvements and incentives for development. Public infrastructure and property improvements will be financed by a combination of TIF increments and debt financing.

The State of Wisconsin classifies city TIDs into several categories: rehabilitation, blight removal, industrial, mixed-use, and environmental remediation districts. Tax Increment Districts terminate once either all costs are paid through increment financing or the mandated termination date passes. Upon termination, the taxing jurisdictions within the TID share in the post-TIF tax revenue generated through improvements during the TID’s lifetime.

See Figure below for a diagram/example of a TID lifespan and process.

What are TID Eligible Project Costs?

Wisconsin statutes outline the eligible project costs including public works and infrastructure improvements; utility services; real property assembly costs; the clearing and grading of land; construction, repair, remodeling, reconstruction or demolition of buildings and structures; professional services; administrative and organizational costs; relocation costs; cash grants covered by a developer agreement; loans or contribution of funds in furtherance of urban redevelopment; environmental remediation; financing costs and other payments made in the discretion of the local legislative body.

What are TID Eligible Project Costs?

The city uses tax increment financing to accomplish these major objectives:

- Attract and expand new and existing services, developments, and employers.

- Increase the city’s property tax base and maintain tax base diversity.

- Expand the economy to create more living-wage jobs.

- Conduct environmental remediation and provide clean land and sites for uses that achieve the city’s redevelopment objectives.

- Eliminate blight influences.

- Support neighborhoods by encouraging residential growth and retail services.

- Support downtown redevelopment efforts that enhance and preserve the character and amenities.

- Maintain and improve the city’s public infrastructure.

TID Project Plans

- TID No. 1 -Closed

- TID No. 2 -Closed

- TID No. 3 -Closed

- TID No. 4 -Closed

- TID No. 5 -Closed (2021)

- TID No. 6 -Closed (2022)

- TID No. 7 Project Plan and Maps (including amendments) - Click here to view

- TID No. 8 Project Plan and Maps (including amendments) - Click here to view

- TID No. 9 Project Plan and Maps (including amendments) - Click here to view

- TID No. 10 Project Plan and Maps (including amendments) - Click here to view

- TID No. 11 Project Plan and Maps (including amendments) - Click here to view

- TID No. 12 Project Plan and Maps (including amendments) - Click here to view

- TID No. 13 Project Plan and Maps (including amendments) - Click here to view

- TID No. 14 Project Plan and Maps (including amendments) - Click here to view

- TID No. 15 Project Plan and Maps (including amendments) - Click here to view

- TID No. 16 Project Plan and Maps (including amendments) - Click here to view

- TID No. 17 Project Plan and Maps (including amendments) - Click here to view

Composite Map

Link to Interactive Map

Annual Reports

2020 Annual TID Report - Click here to view

2021 Annual TID Report - Click here to view

2022 Annual TID Report - Click here to view

Resources

- Request Option to Purchase City Property Memo: Request to Purchase City Property Memo

- Request of Tax Incremental Financing Assistance Memo: Offer to Purchase and TIF Process 2022 Memo

Additional information is available from the Wisconsin Department of Revenue (PDF).

Contact us for questions on Tax Increment District

Request of TIF Assistance

What is TIF?

Tax Incremental Financing (TIF) is a special funding tool available to local municipalities that spurs economic development which otherwise would not occur. When a Tax Increment District (TID) is created property owners within the district continue to pay the same property tax rates as those outside the district.

The difference is that tax collections, over and above the "base value" are placed into a special fund that is used to pay for project costs. Once all costs incurred by the creation of the TID are recouped by the additional tax increment created the TID is closed and the additional property taxes created are shared by all taxing entities. The use of TIF varies from project to project and district to district. In some cases, the City uses TIF to promote redevelopment of older parts of the community. In other cases, the City uses TIF to create industrial parks through land acquisition and construction of infrastructure. In both cases, increased property tax collections are used to pay down debt service associated with project costs. The following outlines the City's policy regarding TIF.

Purpose:

The purpose of this guide is to articulate to existing or potential businesses the City of De Pere's desire to promote economic development that is consistent with the City's Comprehensive Plan and provides a community benefit that will ultimately be shared by all taxing entities (City, School, Technical College, County, and State) impacted through the establishment of Tax Increment District (TID).

Notwithstanding compliance with any or all the guidelines herein, the provision of TIF assistance is a guide to be evaluated on a case-by-case basis by the Common Council. The burden of establishing the public value of TIF shall be placed upon the applicant and the application must substantially meet the criteria contained herein. City staff reserves the right to bring any TIF proposal forward for Council consideration.

Meeting statutory requirements, policy guidelines, or other criteria listed herein does not guarantee the provision of TIF financial assistance nor does the approval or denial of one project set a precedent for approval or denial of another project.

TIF Authority:

The authority and regulations for Tax Incremental Financing and the establishment of Tax Increment Districts are found in Wis. Stats. 66.1105. The City of De Pere reserves the right to be more restrictive than provided under the statutes.

Basic Provisions:

The City of De Pere will consider using Tax Incremental Financing to assist private development in those circumstances where the proposed private project shows a demonstrated financial gap and that the financial assistance request is the minimum necessary to make the project feasible. The developer is expected to have exhausted every other financial alternative(s) prior to requesting the use of TIF, including equity participation, other federal and state funds, bonds, tax credits, loans, etc.

It is the intent of the City to provide the minimum amount of Tax Incremental Financing assistance to make the project viable and not solely to broaden a developer's profit margin on the project. Prior to consideration of a Tax Incremental Financing request, the City will undertake (at the requestor's cost) an independent analysis of the project to ensure the request for assistance is valid.

In requesting TIF assistance, the developer must demonstrate that there will be a substantial and significant public benefit to the community by eliminating blight, strengthening the economic and employment base of the City, positively impacting surrounding neighborhoods, increasing property values and the tax base, creating new and retaining existing jobs, and implementing the Comprehensive Plan.

Each project and location is unique and therefore every proposal shall be evaluated on its individual merit, including its potential impact on city service levels, its overall contribution to the economy and its consistency with the Comprehensive Plan, Strategic Plan or other community planning documents. Each project must demonstrate probability of financial success.

"But for”

The fundamental principle and that which the City must determine through information provided by the developer is that the project would not occur "but for" the assistance provided through Tax Incremental Financing. The burden is on the developer to make this case to the City and not the City to make this case for the developer. Should this "but for" determination not be made, Tax Incremental Financing for the project cannot move forward.

Pro Forma Income and Expense Schedule

Applicants whose projects involve the rental of commercial, retail, industrial, or living units must submit project pro formas that identify income and expense projections on an annual basis for a minimum eleven-year period. If you expect a reversion of the asset after a holding period please include that in your pro forma as well. Please check with city staff to determine the time period needed for the pro forma. Identify all assumptions (such as absorption, vacancies, debt service, operational costs, etc.) that serve as the basis for the pro formas. Two sets of pro formas are to be submitted. The first set should show the project without TIF assistance and the second set with TIF assistance.

For owner-occupied industrial and commercial projects, detailed financial information must be presented that supports the need for financial assistance (see below).

Analysis of Financial Need – “But For”

Each application must include financial analyses that demonstrate the need for TIF assistance. Two analyses must be submitted: one WITHOUT TIF assistance and one WITH TIF assistance. The applicant must indicate the minimum return or profit the applicant needs to proceed with the project and rationale for this minimum return or profit. The analyses will necessarily differ according to the type of project that is being developed.

Rental Property: For projects involving rental of space by the developer to tenants (tenants include offices, retail stores, industrial companies, and households), an internal rate of return on equity must be computed with and without TIF assistance based on the pro forma of income and expense prepared for the Income and Expense Schedule below. The reversion at the end of the ten-year holding period must be based on the capitalized 11th year net operating income. The reversionary value is then added to the 10th year cash flow before discounting to present value. State all assumptions to the analyses.

For Sale Residential: Show profit as a percent of project cost (minus developer fee and overhead and minus sales commissions and closing costs, which should be subtracted from gross sales revenue). Other measure of profitability may be submitted, such as profit as a percent of sales revenue.

Mixed Use Commercial/For-Sale Residential: Provide either separate analyses for each component of the project or include in the revenue sources for the for-sale portion, the sale value of the commercial component based on the net operating income of the commercial space at stabilization. Indicate how the sale value was derived.

Owner-Occupied Commercial: For projects, such as "big-box" retail projects, provide copies of the analyses that the company needs to meet or exceed the company's minimum investment threshold (s) for proceeding with the project.

Competitive Projects: In instances where the City is competing with other jurisdictions for the project (e.g., corporate headquarters, new manufacturing plant), present detailed analyses that demonstrate the capital and operating cost differential between the proposed location(s) in De Pere and locations that are seriously being considered by the applicant.

The following page can be used to provide the revenue and expense assumptions; however, if the applicant wishes to provide their own attachment, please ensure it addresses the items included below.

Application

Please complete and submit the following information to the City of De Pere for a more detailed review of the feasibility of your request for Tax Incremental Financing (TIF) assistance.

Where there is not enough space for your response or additional information is requested, please use an attachment. Use attachments only when necessary and to provide clarifying or additional information.

The Development Services Department reviews all applications for TIF assistance. Failure to provide all required information in a complete and accurate manner could delay processing of your application and the City reserves the right to reject or halt processing the application for incomplete submittals.

Contact us to learn how we can help.